Maine Launches $50 Million Homeowner Assistance Fund

Governor Janet Mills, U.S. Senator Angus King, and Representative Chellie Pingree announced that the Maine Bureau of Consumer Credit Protection will establish a $50 million Maine Homeowner Assistance Fund. This program provides direct assistance to Maine homeowners who are at risk of losing their homes as a result of the COVID-19 pandemic’s problems. These funds can be used to cover home-related expenses including their mortgage, utilities, and property taxes. Eligible applicants may apply for the amount they are behind on payments up to a maximum of $25,000.00, including up to $15,000.00 in property tax assistance and $10,000.00 in utility payment relief. Their mortgage servicer will need to agree to a loan modification or loss mitigation plan if the delinquent exceeds the program cap.

“The pandemic has been hard for a lot of Maine people, stretching wallets thinner and forcing hardworking folks to reach deeper in their pockets to make ends meet. Thankfully, the American Rescue Plan is delivering relief for those who need it,” said Governor Janet Mills. “With the Homeowner Assistance Fund, Maine people may be eligible for support with their mortgage, utilities, property taxes, and other expenses that can help get them through this tough time.”

What can the Maine HAF program cover?

According to the Maine Bureau of Consumer Credit Protection, an agency within the Department of Professional and Financial Regulation official site, the Maine HAF will provide homeowners who were affected by COVID-19 with several types of support, including:

- Paying off past due mortgage payments;

- Providing financial assistance to reinstate a mortgage or to pay other housing-related costs related to a period of forbearance, delinquency, or default;

- Paying off past due homeowner’s insurance, flood insurance, and mortgage insurance;

- Paying off property taxes to prevent tax foreclosures;

- Paying off utilities, including electric, gas, sewage, and water bills that are past due;

- Paying off past due amounts for internet services, including broadband internet access service;

- Paying off past due homeowner association or condominium association fees; and

- Paying off past due manufactured home loan debt (chattel loan or retail installment contracts).

“The American Rescue Plan was designed to help families and communities recover from the lingering impacts of the COVID-19 pandemic, and this program displays how the legislation is continuing to deliver on those goals,” said Senator King. “People across our state have been impacted by the pandemic’s economic fallout and today’s action will help families access the support they need to stabilize their household budgets. I’m deeply grateful to Governor Mills for her ongoing leadership in the face of this crisis, and will continue to work hand-in-hand with her administration to help Maine people weather these challenges.”

Who is eligible for the Maine Homeowners Assistance Fund program?

Homeowner applicants must meet all the following criteria to be eligible for assistance:

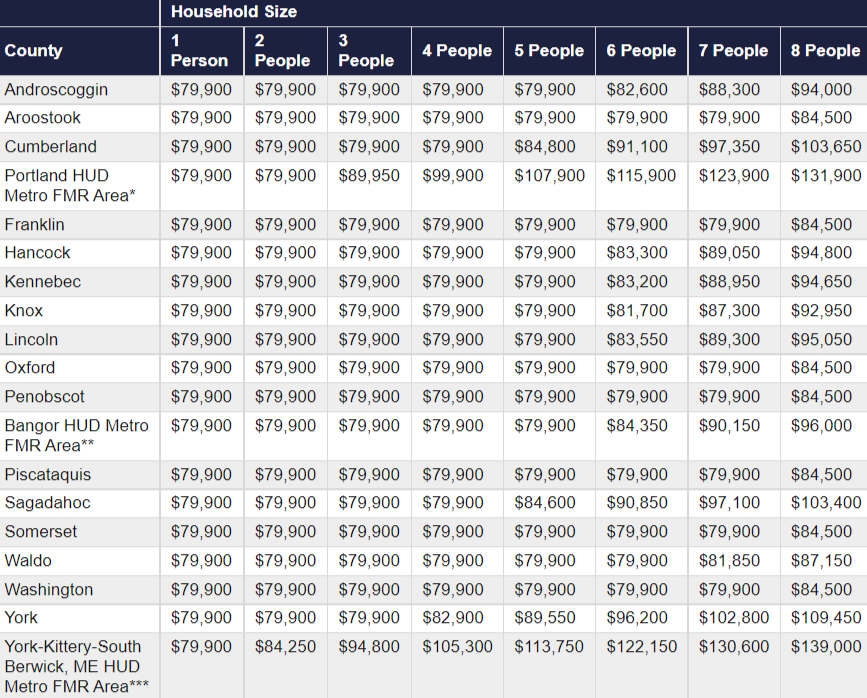

- The applicants’ household must be below certain income limits. These limits vary by household size. This table below shows eligibility income limits for the Maine HAF at 100% of area median income (AMI). Certain municipalities in Cumberland, Penobscot, and York Counties have different income limits than other municipalities in the same county

- They must own and occupy a 1 to 4-unit dwelling in Maine

- They must have experienced a COVID-19 related financial hardship after January 21, 2020 (a financial hardship is a material reduction of income or a material increase in expenses).

They added that because their state has the highest median age in the country, such homeowners are particularly vulnerable. Many of the state’s citizens are retirees on fixed incomes, according to Nicole DiGeronimo, director of Avesta Housing’s Homeownership Center, and mortgage payments can be out of reach for many when other expenses rise.

For more information on getting a grant and also learning about refinance programs, take a look at this.

To determine if they are eligible for assistance, homeowners can begin the application process at Maine Homeowner Assistance Fund program’s official site. For more information, contact the Bureau of Consumer Credit Protection’s hotline at 1-888-664-2569 or Maine Housing Counselors.