How Do I Get My California Solar Rebate?

There are plenty of solar tax incentives available in California if you are planning on installing solar panels and batteries. Going solar in 2021 is essential for reducing carbon emissions by using renewable clean energy from the sun and lowering your monthly energy costs.

|

Did you know that there are several Ohio solar incentives, rebates, and programs expiring in 2023? Before you start worrying, you should know that there are unbelievable new incentives here now! Check out one of the most popular resources for learning about these programs in the link below.

Access Ohio Solar Programs |

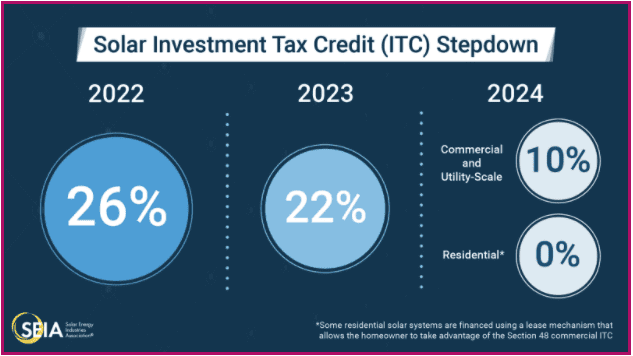

The Solar Investment Tax Credit, or ITC, is the most important federal policy tool supporting the growth of solar energy. This system was put in place in 2006 and has enabled the solar business in the United States to grow by more than 10,000 percent. This credit is available after your home has a solar system installed. The amount you will receive is determined by the construction year. In any given year, any homeowner who purchases and owns a PV system can claim and deduct this proportion from their federal taxes. Solar tax incentives are available for both residential and business solar installations. Solar energy ITC is currently a one-time credit. If you can’t use all of the profits before archiving, you can transfer them to the following year. You can claim the federal solar cell tax deduction if you live in the United States and own a solar panel system installed in your home.

The percentage that you can get is the following:

- 26 percent for projects that begin construction in 2021 and 2022,

- 22 percent for projects that begin construction in 2023,

- After 2023, the residential credit drops to zero while the commercial credit drops to a permanent 10 percent.

To apply for this credit you must meet certain criteria, such as:

- The solar PV system is located at your primary or secondary residence in the United States, or for an off-site community solar project, if the electricity generated is credited against, and does not exceed, your home’s electricity consumption,

- You own the solar PV system (i.e., you purchased it with cash or through financing but you are neither leasing nor are in an arrangement to purchase electricity generated by a system you do not own),

- The solar PV system is new or being used for the first time. The credit can only be claimed on the “original installation” of the solar equipment.

The Solar Investment Tax Credit (ITC) is a non-refundable tax credit, but it can’t surpass the amount of taxes you owe. If your tax liability is less than your credit, the tax deduction can be carried forward for up to five years. There are certain conditions when home solar batteries qualify for this mechanism. DIY solar installations are also eligible, excluding your own labor.

You must include IRS Form 5695 with your tax return to receive the credit. On Part I of the form, you compute the credit and then enter the result on your 1040. From the due date of your tax return, you have three years to file and collect a refund. You can still claim the Solar Investment Tax Credit for earlier years if you were eligible: If you file your tax return before May 17, 2024, you will receive a refund for 2020. If you file your tax return by July 15, 2023, you will receive a refund for 2019.