The Ultimate Guide to the Federal Residential Renewable Energy Tax Credit for Homeowners

|

Did you know that there are several Ohio solar incentives, rebates, and programs expiring in 2023? Before you start worrying, you should know that there are unbelievable new incentives here now! Check out one of the most popular resources for learning about these programs in the link below. |

The installation of solar panels in your home can lower your energy costs a lot in the long term and reduce the environmental impact of your home, but going solar is not cheap. According to Forbes, the average price of solar panels is around $16,000.00, or between 3,500.00 and $35,00.00, depending on the type and model you use. Luckily, there are plenty of rebates and incentives available today that help homeowners install solar panels for less. One of those incentives is the Federal Residential Renewable Energy Tax Credit or Investment Tax Credit (ITC) which we will explain in this article.

If you would like to speak someone about solar programs you can contact our partner here.

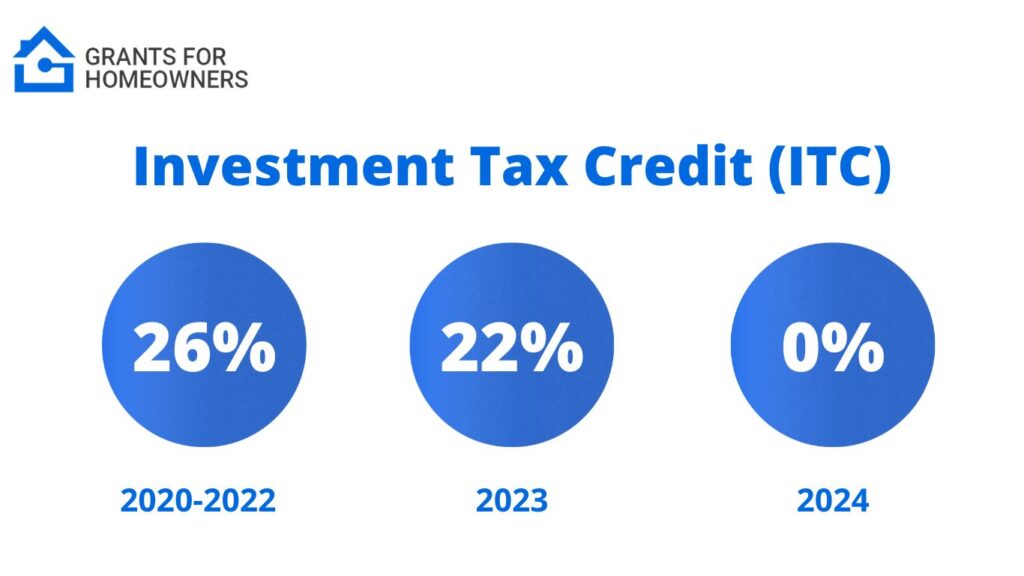

Let’s start by explaining what tax credit really is. When you install solar panels in your home, you earn tax credits. These credits lower your tax bills for the tax year you installed your panels. The Investment Tax Credit (ITC) was enacted in 2006 and according to the Solar Energy Industries Association (SEIA), the solar industry in the US has grown 10,000% since then. The solar industry also creates thousands of jobs and contributes to the nation’s economy by injecting billions of dollars into it. This makes it one of the most important federal policy mechanisms. The tax credit’s expiration date was extended by Congress multiple times, but the final ending is in 2024, and there are currently no signs that it will be extended again.

The Investment Tax Credit is currently 26% of the price of systems installed. Projects that begin construction in 2023 can use 22%, and for those after that, the residential credit drops to zero. The tax credit expires starting in 2024 unless Congress renews it. Before 2019, applicants could claim 30%. Because it is nonrefundable, you won’t receive a tax refund for the excess of the tax credit over your tax obligation. However, you are permitted to carry over any unused tax credit funds to the following tax year. The credit is divided by the amount of your federal tax liability, so if you receive $1,000.00 in credits, your tax liability will be reduced by $1,000.00.

For example, the 26% ITC would entitle you to a $2,600.00 tax credit if you spent $10,000.00 installing solar on your home in 2021 and 2022. One interesting fact about this tax credit is that there is no maximum amount that can be claimed. Applicants are not permitted to claim the solar tax credit twice. However, they are able to claim different tax credits for solar installations on each of the properties if they own more than one.

Who is eligible for the Investment Tax Credit?

There are some requirements that must be met to claim this credit. The solar PV system must be installed between 2006 and 31st December 2023, and it must be located in US territory. It has to be installed on the applicant’s primary or secondary residence, or on an off-site community solar project. You can claim a portion of the credit on your taxes as long as you own the property and live in it for a portion of the year. However, you cannot claim the solar energy tax credit if you install solar on a home that is strictly an investment, such as one that you rent out full-time.

The applicant must own the system, not lease it. The company that leases the system or provides the PPA will be the one to file for the ITC if the homeowners lease the solar system or use it to purchase electricity through a power purchase agreement (PPA). If you have just bought a house with an installed system, you can also claim a credit for that if it is new.

Applicants don’t have to be homeowners to claim the ITC. If tenant-stockholders at a cooperative housing corporation and members of condominiums pay a portion of the system’s cost, they are eligible. They would use the amount they paid, and not the total amount when filing.

The total cost of the solar system includes solar PV panels or PV cells used to power an attic fan (but not the fan itself), mounting equipment, labor work, balance-of-system equipment, including wiring, inverters,, and energy storage devices used, as well as inspections costs and sales taxes.

If your utility company provides some sort of subsidies, they are excluded from income taxes through an exemption in federal law. This means that the amount is subtracted from the total solar system installation amount before you calculate your tax credit. But, this is not the case if you have received some sort of state incentive. In that case, you calculate your tax credit on the total amount.

If you would like to speak someone about solar programs you can contact our partner here.

How do I claim the Investment Tax Credit (ITC)?

Using Tax Form 5695, you can submit the Solar Investment Tax Credit just once for the tax year in which your system is installed. If you are eligible for the Investment Tax Credit, complete the IRS Form 5695 and attach it to your federal tax return (Form 1040 or Form 1040NR). /this form is also available online. For more information, call the Internal Revenue Service (IRS) at (800)829-1040.