Oro y Plata for the Treasure State: How Montana Homeowners can get Federal Assistance

Inflation, geopolitical turmoil, and a weakening economy dominate the headlines today. These and other factors weigh heavily on American homeowners, particularly those in the lower and middle classes. But one seemingly forgotten news event still has an outsized impact that’s only compounded by today’s economic troubles – COVID-19.

Thankfully, some states and federal agencies recognize the ongoing impact of COVID-19 on homeowners, and Montana is one such state offering federal assistance through the Montana Department of Commerce.

|

Ohio mortgage programs may be able to save you hundreds every month. A new 2024 mortgage may be able to give relief to homeowners. Unfortunately, most Americans will not receive their mortgage benefits because they are not aware of some of these programs. You do not need to pay anything to check how much you could get.

Check Ohio Programs Here |

Montana Housing’s Homeowner Assistance Fund

The Montana Housing Homeowner Assistance Fund, or HAF, is a $50M federal grant under the nearly $10B American Rescue Plan Act. The fund exists to help lower and middle-income families and homeowners experiencing strife in the post-pandemic economy.

Eligibility

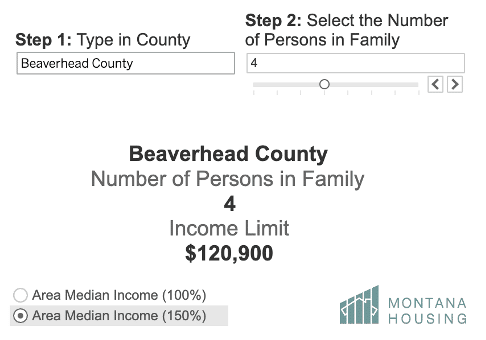

To be eligible for assistance under the Montana HAF, you’ll need to be a Montana resident with a gross household income at or below 150% of the area’s median income. Not sure if that’s you? The Montana HAF page has a helpful calculator to see if you qualify. We’ll look at a quick example assuming a family of four living in Beaverhead County:

The calculator shows us that, in this example, a family of four in Beaverhead County would need to have a gross household income of $120,900 or less.

What’s Covered?

The Montana HAF sets pretty strict limits on what funds can be used for:

Mortgage Reinstatement

Mortgage reinstatement under the HAF includes assistance with past-due payments, including forbearance. Households are eligible for up to $25,000 under the mortgage reinstatement clause of the Montana HAF.

To be eligible, you’ll need to be listed as a borrower or co-borrower on the mortgage and demonstrate financial hardship due to the pandemic.

Lien Prevention

Lien prevention services under the Montana HAF prevent the creation of liens on homes with the express purpose of helping homeowners stay in place. Households are eligible for up to $5,000 under this clause but will need to have delinquent property taxes, homeowner association fees, or insurance – all indicators of an imminent lien.

Utility Payment Assistance

This clause helps homeowners pay for delinquent utility services like electricity and water. The money, up to $300 monthly, can go directly towards late utility bills and pay interest and legal fees if applicable. Assistance is prioritized under this provision:

- Prevention of utility shut-off.

- Payment of past due utilities.

- Up to three months of future utilities.

What You’ll Need

If you qualify, make sure you do the legwork before applying to expedite your assistance. The Montana HAF recommends:

- Contact your mortgage servicer and see if they have any assistance options available.

- Contact HUD-approved counselors for federal assistance.

- Get all documentation you’ll need. A good rule of thumb is to get anything you might need, but the Montana HAF recommends explicitly:

- Income verification, like a paystub or W2.

- Mortgage servicer verification that you’ve contacted them for assistance.

- Your most recent mortgage statement.

- The deed for your home.

- Utility shut-off notice and utility bills.

It isn’t too difficult to work through the application process, but by ensuring due diligence, you increase the likelihood and speed of assistance.

Not a Montanan homeowner or need additional assistance? You can always explore your refinancing options here.